All Categories

Featured

Table of Contents

Term life insurance policy is a type of policy that lasts a certain size of time, called the term. You pick the length of the plan term when you initially obtain your life insurance policy. It can be 5 years, twenty years or perhaps much more. If you pass away throughout the pre-selected term (and you've stayed on par with your costs), your insurer will certainly pay out a round figure to your nominated beneficiaries.

Select your term and your amount of cover. Select the policy that's right for you., you recognize your costs will stay the same throughout the term of the policy.

Level Term Life Insurance Policy

Life insurance coverage covers most circumstances of fatality, however there will certainly be some exclusions in the terms of the plan - Level term life insurance vs whole life.

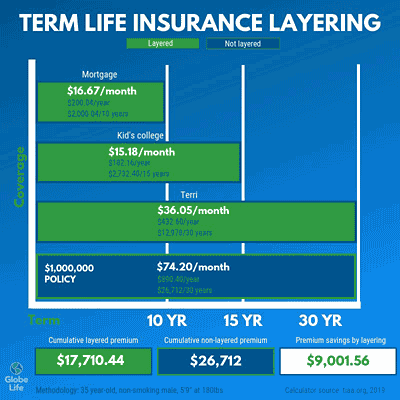

After this, the plan ends and the surviving partner is no longer covered. People frequently take out joint plans if they have impressive monetary commitments like a home mortgage, or if they have youngsters. Joint plans are generally a lot more inexpensive than solitary life insurance policy policies. Other kinds of term life insurance policy policy are:Reducing term life insurance policy - The quantity of cover reduces over the length of the plan.

This safeguards the buying power of your cover amount versus inflationLife cover is an excellent point to have because it supplies financial protection for your dependents if the most awful occurs and you die. Your liked ones can also utilize your life insurance policy payout to pay for your funeral. Whatever they select to do, it's fantastic satisfaction for you.

Level term cover is excellent for fulfilling daily living costs such as house bills. You can additionally use your life insurance policy advantage to cover your interest-only mortgage, payment home loan, institution charges or any kind of other financial debts or ongoing repayments. On the other hand, there are some drawbacks to level cover, contrasted to other types of life policy.

What types of Level Term Life Insurance Protection are available?

The word "degree" in the phrase "level term insurance policy" indicates that this kind of insurance coverage has a set costs and face amount (survivor benefit) throughout the life of the policy. Just placed, when individuals talk concerning term life insurance policy, they normally describe degree term life insurance policy. For the bulk of people, it is the most basic and most affordable choice of all life insurance policy kinds.

The word "term" below describes a given variety of years throughout which the level term life insurance policy stays energetic. Level term life insurance policy is one of one of the most prominent life insurance policy policies that life insurance policy providers supply to their customers because of its simplicity and cost. It is likewise easy to compare degree term life insurance policy quotes and obtain the very best premiums.

The mechanism is as follows: Firstly, select a policy, fatality advantage amount and plan period (or term size). Second of all, select to pay on either a month-to-month or annual basis. If your premature demise occurs within the life of the plan, your life insurance company will pay a round figure of death benefit to your established beneficiaries.

Level Term Life Insurance Policy Options

Your level term life insurance policy policy ends once you come to the end of your policy's term. At this factor, you have the adhering to options: Alternative A: Remain uninsured. This alternative fits you when you can insure by yourself and when you have no financial debts or dependents. Option B: Get a brand-new degree term life insurance policy.

Your existing browser might restrict that experience. You may be utilizing an old browser that's in need of support, or settings within your browser that are not compatible with our website.

Is there a budget-friendly Level Term Life Insurance Coverage option?

Already using an upgraded browser and still having difficulty? Your current browser: Detecting ...

If the policy expires before ends death or you live beyond the policy term, there is no payout. You may be able to renew a term policy at expiry, however the premiums will be recalculated based on your age at the time of revival.

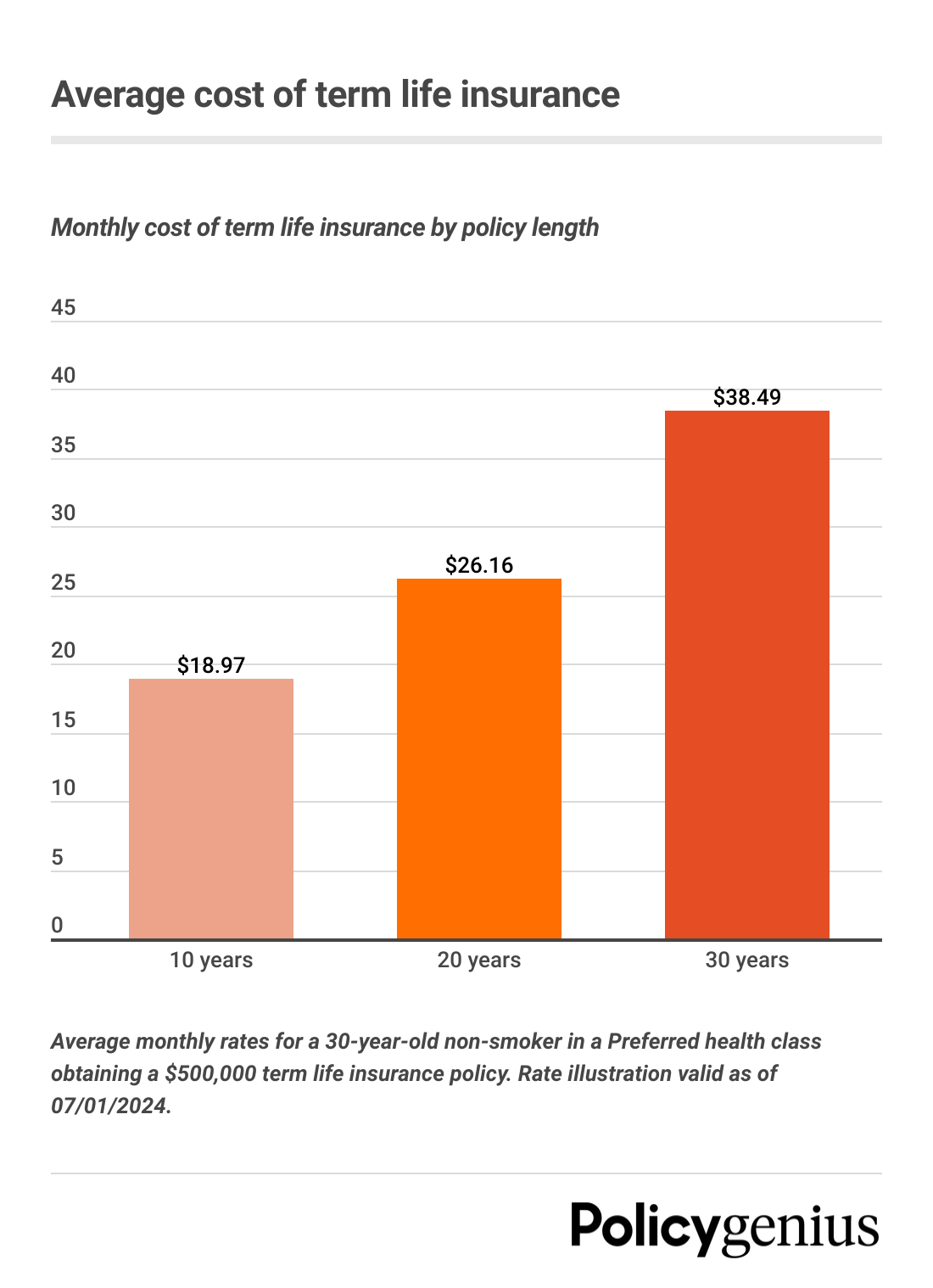

As you can see, the very same 30-year-old healthy and balanced male would certainly pay an average of $282 a month. At 50, he 'd pay $571. Whole Life Insurance Coverage Rates 30 $282 $247 40 $382 $352 50 $571 $498 60 $887 $782 Resource: Quotacy. Quotes are for a $500,000 irreversible life insurance coverage plan, for males and females in exceptional health and wellness.

What are the top Level Term Life Insurance Premiums providers in my area?

That reduces the total risk to the insurance firm compared to a permanent life plan. Passion rates, the financials of the insurance coverage firm, and state policies can additionally impact costs.

He gets a 10-year, $500,000 term life insurance plan with a costs of $50 per month. If George passes away within the 10-year term, the plan will pay George's recipient $500,000.

If he stays alive and renews the plan after ten years, the premiums will be greater than his preliminary plan since they will certainly be based on his present age of 40 instead of 30. Level term life insurance for seniors. If George is identified with an incurable health problem throughout the initial policy term, he possibly will not be qualified to renew the plan when it expires

There are a number of kinds of term life insurance. The best alternative will depend on your individual conditions. Most term life insurance coverage has a degree costs, and it's the type we've been referring to in many of this post.

How do I get Term Life Insurance With Fixed Premiums?

Thus, the premiums can become much too pricey as the insurance holder ages. However they might be a good choice for someone that requires short-lived insurance coverage. These policies have a death advantage that decreases yearly according to an established schedule. The policyholder pays a repaired, level costs for the duration of the policy.

Latest Posts

Instant Quotes Life Insurance

Funeral Expense Benefits For Seniors

Funeral Insurance Underwriters