All Categories

Featured

Table of Contents

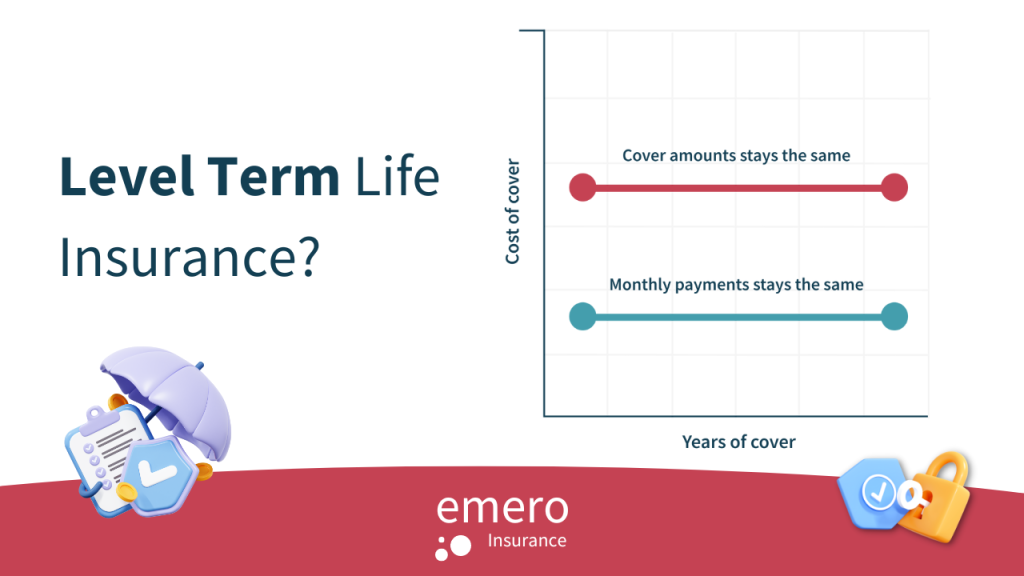

A level term life insurance policy policy can give you peace of mind that the individuals that rely on you will certainly have a survivor benefit throughout the years that you are preparing to support them. It's a way to help care for them in the future, today. A degree term life insurance policy (sometimes called degree costs term life insurance coverage) plan provides coverage for an established variety of years (e.g., 10 or 20 years) while maintaining the premium settlements the very same throughout of the plan.

With level term insurance policy, the expense of the insurance policy will certainly remain the exact same (or possibly decrease if rewards are paid) over the regard to your plan, normally 10 or two decades. Unlike permanent life insurance policy, which never runs out as lengthy as you pay premiums, a degree term life insurance policy plan will finish at some time in the future, normally at the end of the period of your degree term.

What You Should Know About Term Life Insurance With Accelerated Death Benefit

Due to this, many individuals use long-term insurance policy as a steady monetary preparation tool that can serve numerous needs. You may be able to transform some, or all, of your term insurance policy throughout a collection duration, normally the initial ten years of your plan, without needing to re-qualify for protection even if your health has transformed.

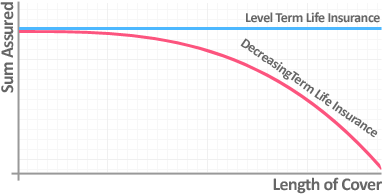

As it does, you may intend to include in your insurance policy coverage in the future. When you initially obtain insurance coverage, you may have little cost savings and a huge mortgage. Ultimately, your financial savings will certainly grow and your home mortgage will certainly reduce. As this occurs, you might want to ultimately decrease your fatality advantage or take into consideration converting your term insurance policy to a permanent policy.

So long as you pay your premiums, you can relax easy understanding that your enjoyed ones will obtain a survivor benefit if you die throughout the term. Several term plans allow you the capability to convert to long-term insurance policy without needing to take one more wellness examination. This can allow you to benefit from the added advantages of a permanent plan.

Level term life insurance policy is just one of the simplest paths into life insurance coverage, we'll talk about the benefits and disadvantages to make sure that you can select a strategy to fit your needs. Level term life insurance policy is the most usual and fundamental type of term life. When you're seeking temporary life insurance policy strategies, level term life insurance policy is one path that you can go.

You'll fill out an application that contains general personal details such as your name, age, and so on as well as a much more comprehensive set of questions about your clinical history.

The short response is no., for instance, let you have the convenience of death benefits and can accumulate money value over time, indicating you'll have more control over your advantages while you're alive.

What is Level Term Life Insurance Meaning? Find Out Here

Cyclists are optional stipulations added to your plan that can give you added benefits and securities. Anything can happen over the program of your life insurance policy term, and you want to be all set for anything.

There are instances where these advantages are built into your plan, but they can also be offered as a separate enhancement that needs additional repayment.

Latest Posts

Instant Quotes Life Insurance

Funeral Expense Benefits For Seniors

Funeral Insurance Underwriters